The Student Card

Your ideal study companion

- free of charge for the first year*, with an added EUR 25 welcome bonus

- travel insurance protection

- 3 stylish designs to choose from

- new “Raindrop" card made of environmentally-friendly material

Student Card

Student Card

This handy companion is sure to make student life easier. Now available in three different designs, from serious Classic to colorful Rainbow to our latest “Raindrop” card made of environmentally friendly material.

In the first year free of charge, thereafter EUR 3.20 per month*.

*The card fee will be charged annually for 12 months in advance.

All the benefits at a glance

Insurance protection

Your Classic Card provides worldwide travel insurance coverage up to EUR 726,750.

More informationSpecial rates for car rentals

Your Classic Card includes discount rates on various car rentals.

More informationAdditional functions

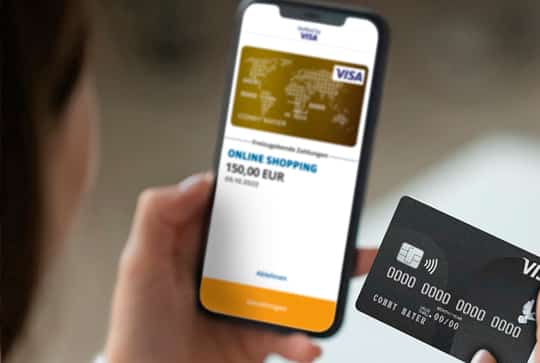

complete Secure

Confirm online payments quickly, conveniently and securely with your Secure Code (your secure password). It's even easier with the complete Control App using fingerprint or FaceID.

compete Control

complete Control allows you to manage your cards anytime, at your own convenience. And with the complete Control app, you can also confirm online payments directly from your mobile phone.

Account statements by e-mail

Once a month an account statement listing all your transactions will be sent to you by e-mail.

PIN

When you make purchases and cash withdrawals with your card, you will be asked to enter your PIN. Did you know? Now you can even create your own PIN!

How can I order my card?

Order your Student Card digitally - quickly and easily - via ID Austria (formerly Handysignatur).

When ordering via VideoID, please note that you will need a webcam, a microphone, a valid photo ID (passport or similar official ID), proof of salary/income (as a PDF or image file) and your mobile phone. VideoID applications can be submitted any day of the week, but only between 7:00 and 22:00 (CET).

Advantages in detail

Travel Insurance

Worldwide Travel Insurance Protection

Your credit card from card complete includes worldwide travel insurance, with coverage up to EUR 750,000 for Gold and Platinum Cards, or EUR 726,750 for Classic Cards. This protection applies automatically all year long, even for journeys not paid for with your card. The only condition is that you use your card regularly (at least once within the last 2 months before a claim). The insurance applies for journeys up to 90 days, but if you want to travel for longer, there is an option to extend the protection to six months.

Examples of coverage:

| Classic | Gold | Platinum | |

| Luggage Insurance incl. Camping Risks | up to € 1,820.- | up to € 2,500.- | up to € 5,000.- |

| Accident Coverage | up to € 72,700.- | up to € 100,000.- | up to € 150,000.- |

| Personal Liability Coverage | up to € 726,750.- | up to € 750,000.- | up to € 750,000.- |

| Medical Treatment | 100% | 100% | 100% |

| Emergency Contact up to 100% | 100% | 100% | 100% |

| Primary Rescue by Helicopter up to 100% | 100% | 100% | 100% |

| Compassionate emergency visit abroad | no | up to € 2,500.- | up to € 2,500.- |

| Flight Delay | up to € 110.- | up to € 250.- | up to € 500.- |

| Motor Vehicle Recovery | up to € 220.- | up to € 250.- | up to € 500.- |

| Motor Vehicle Return | no | up to € 1,000.- (20% Deductible | up to € 2,000.- (20% Deductible) |

| Air Ambulance Transport from abroad up to 100% | 100% | 100% | 100% |

First-time cardholders of Classic Cards with insurance are automatically covered by cancellation insurance for private travel - free of charge in the first year. This cancellation insurance continues in subsequent years, as long as the cardholder has collected at least 200 credits (each credit represents a transaction value of EUR 15) with the card in the previous year.

For more detailed information, please see our Travel Insurance brochure or contact us by telephone at +43 (0)1 711 11-380.

Do you have any questions about our products and services?

Please call us: +43 1 711 11 380 or visit our FAQ section (only available in german).